Table of Contents

- 2025 W9 Form Fillable - Aliza Korney

- W-9 2025 Form - Dorey Lizzie

- IRS Form W-9 ≡ Printable Blank W9 Tax Form for 2024, Free Fillable ...

- Downloadable W-9 Form 2025 - Stacy Ralina

- Blank Will Form Printable - Printable Forms Free Online

- W-9 2025 Form - Dorey Lizzie

- W 9 Form 2025 Printable Pdf 2025 - Richie Lingo

- Blank W9 Forms Printable - Printable Forms Free Online

- Blank W 9 Form For 2024 State And Federal - Andie Blancha

- Blank 2020 W9 Form | Calendar Template Printable

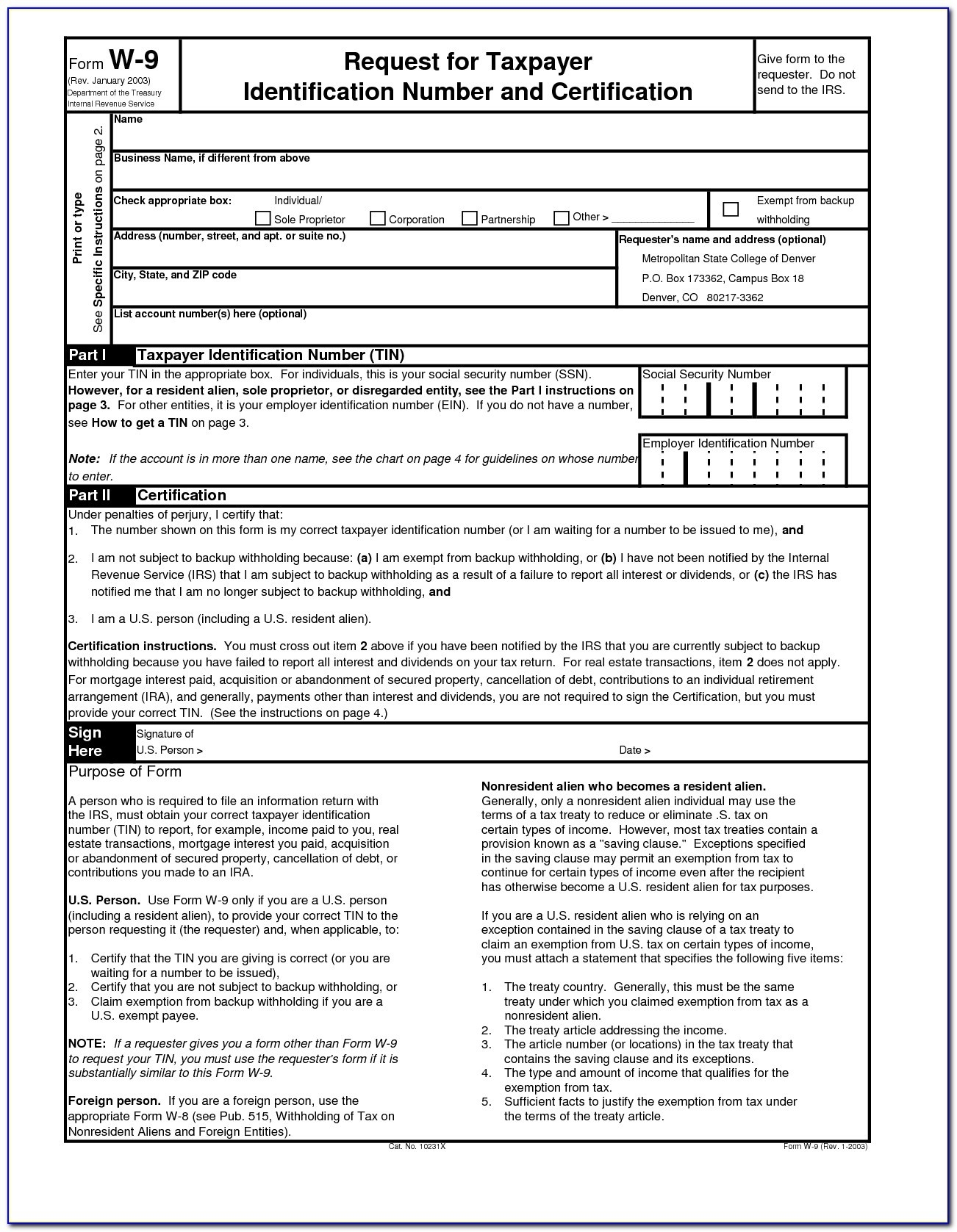

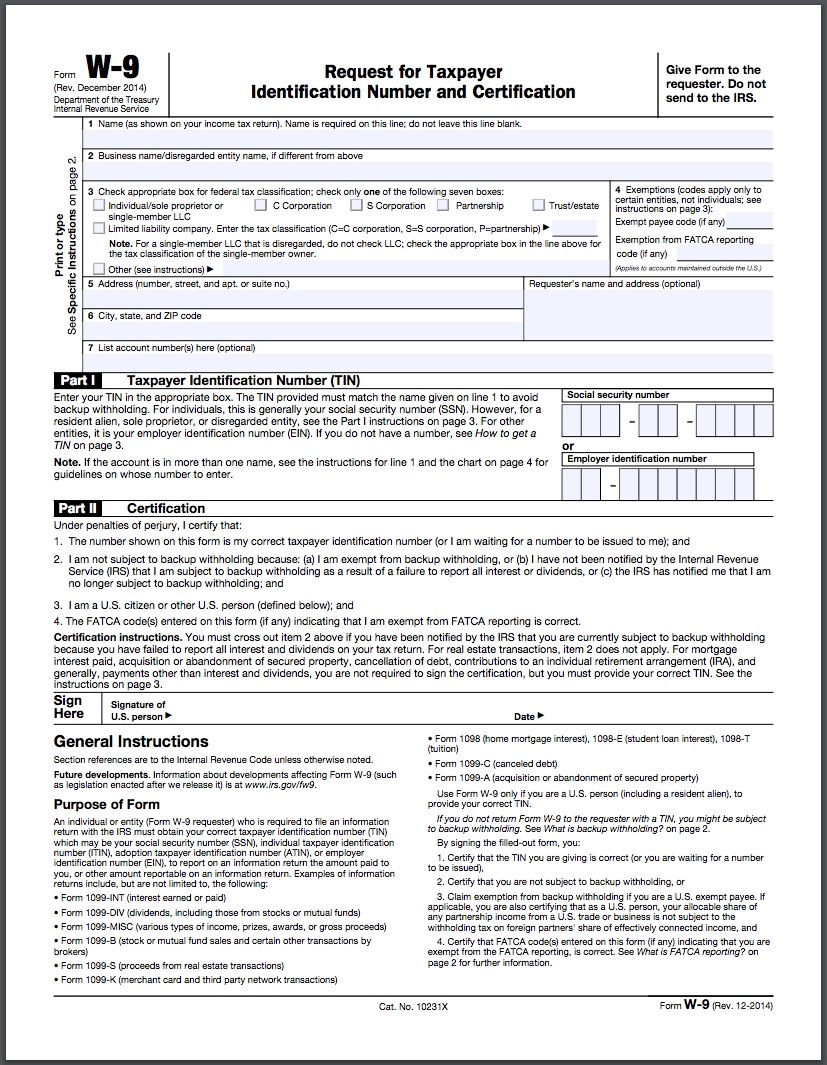

What is the UVA W-9 Form 2025?

Why is the UVA W-9 Form 2025 Important?

How to Complete the UVA W-9 Form 2025

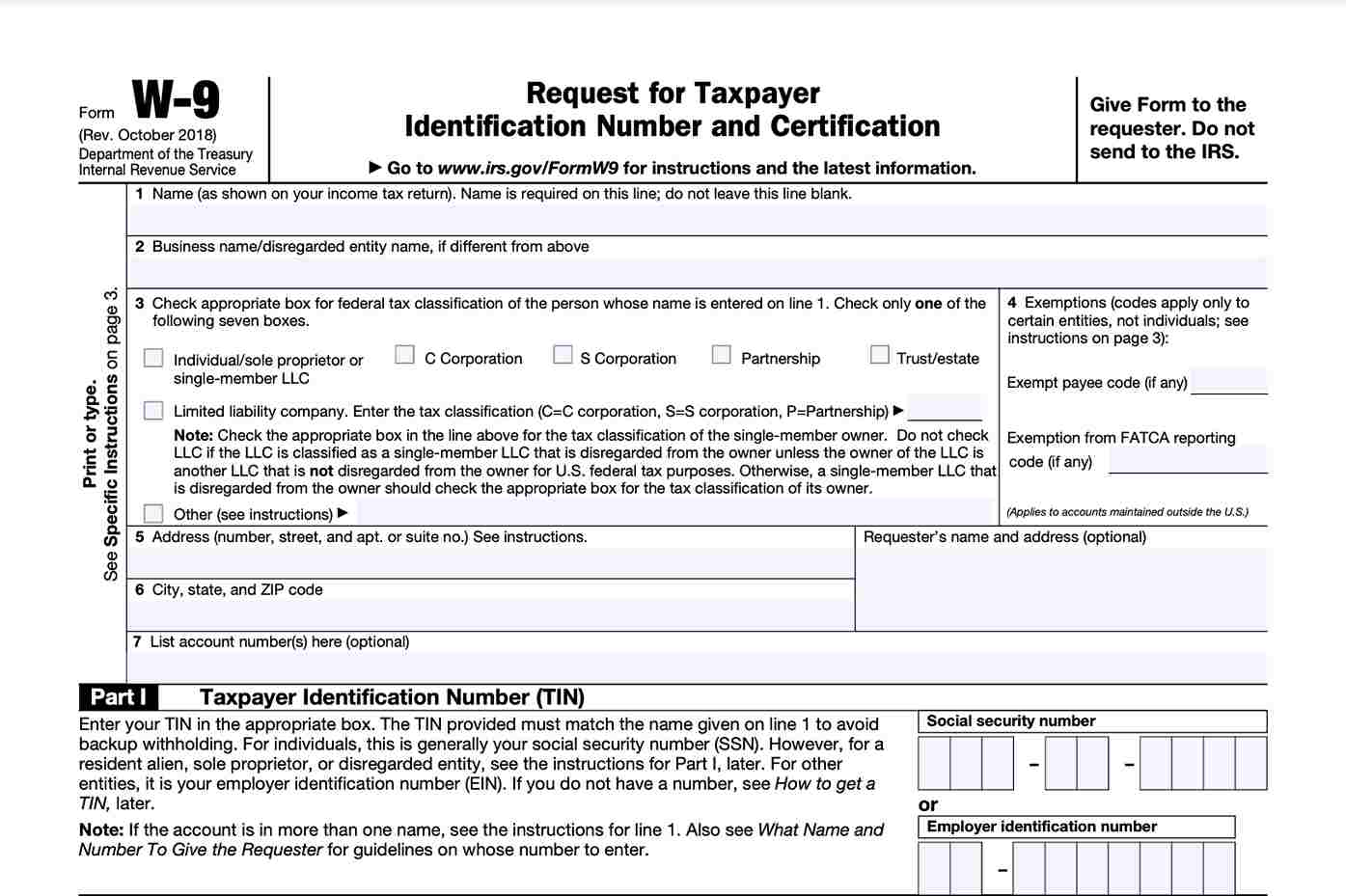

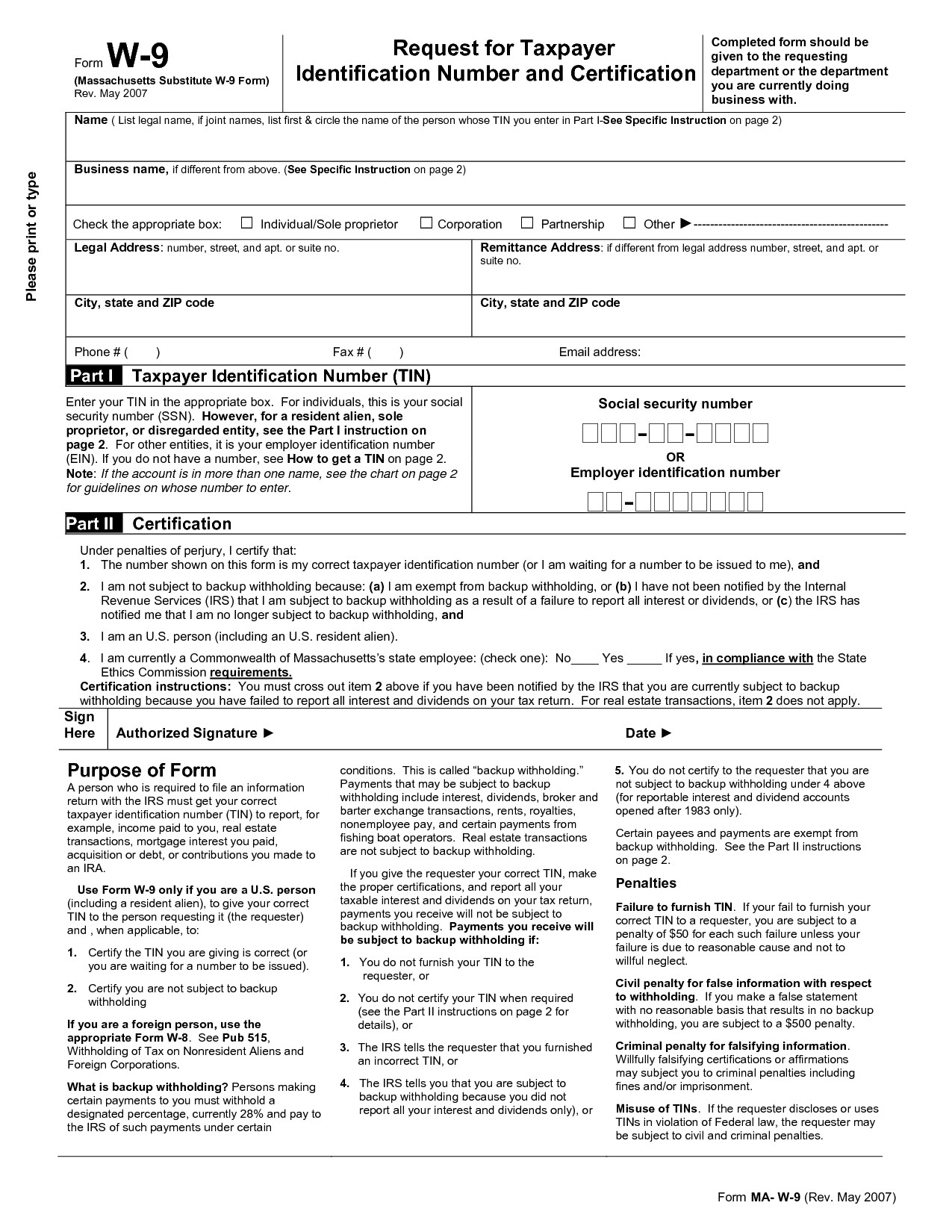

Completing the UVA W-9 Form 2025 is a straightforward process. Here are the steps to follow: 1. Download the form: Obtain the UVA W-9 Form 2025 from the university's finance website or request a copy from the UVA finance department. 2. Provide business information: Enter your business name, address, and Taxpayer Identification Number (TIN). 3. Select your tax classification: Choose the correct tax classification, such as individual, sole proprietor, partnership, or corporation. 4. Certify your information: Sign and date the form to certify that the information provided is accurate and true. 5. Return the form: Submit the completed form to the UVA finance department or follow the instructions provided by the university. In conclusion, the UVA W-9 Form 2025 is a vital document that plays a crucial role in ensuring compliance with tax regulations and maintaining accurate records for the University of Virginia. By understanding the importance of the W-9 form and following the steps to complete it accurately, vendors, contractors, and employees can ensure smooth financial transactions with the university. If you have any questions or concerns about the UVA W-9 Form 2025, please contact the UVA finance department for assistance.Keyword: UVA W-9 Form 2025, UVA Finance, Taxpayer Identification Number, Request for Taxpayer Identification Number and Certification